ON360 Transition Briefings 2022 - Doing More For Those With Less: How To Strengthen Benefits And Programs For Low-Income Individuals And Families In Ontario - Ontario 360

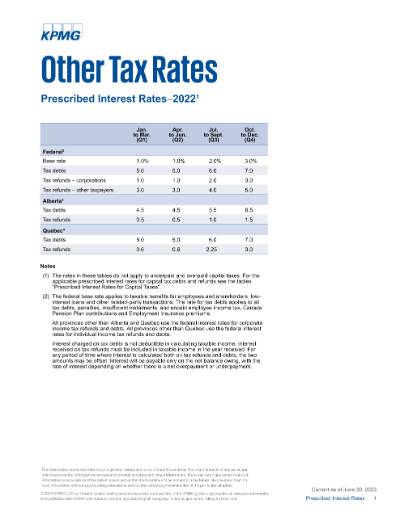

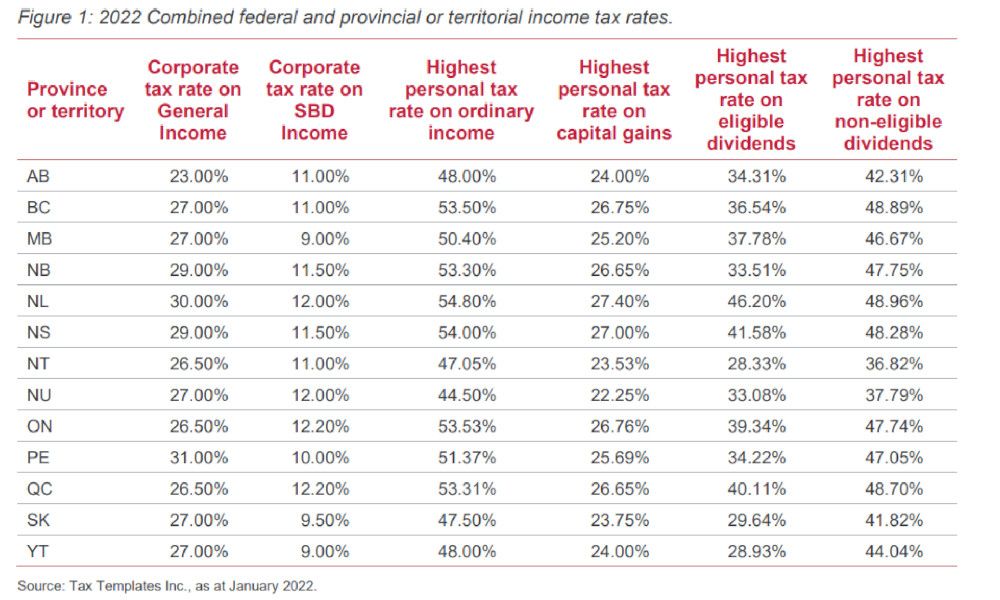

How do you get from Net Income for Tax Purposes to Taxable Income to Tax Payable? – Intermediate Canadian Tax

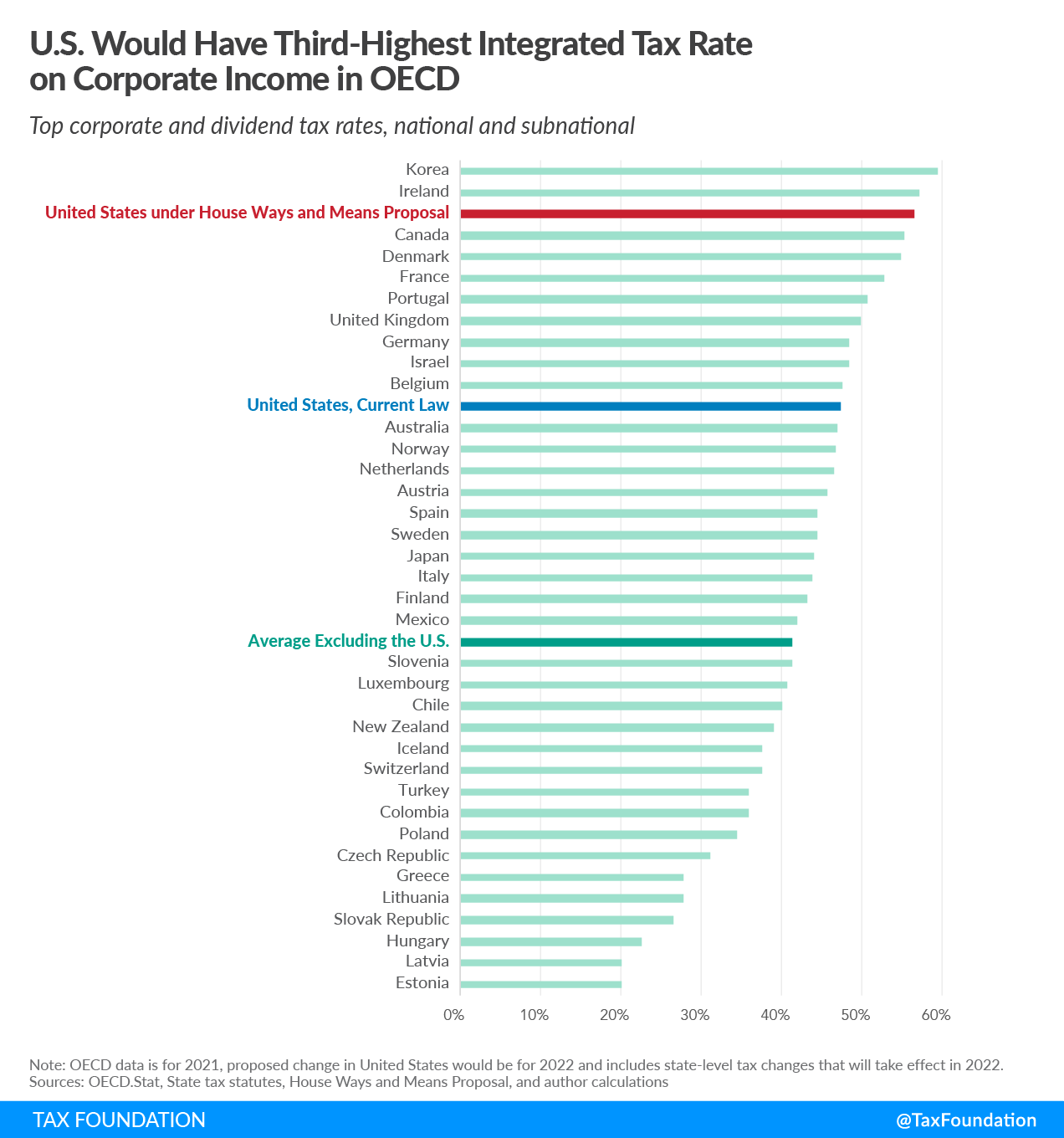

Why won't Canada increase taxes on capital gains of the wealthiest families? FON Commentaries. Vol. 2, No. 20 – Finances of the Nation